By Frank Holmes

Full Article : The War on Cash is Still Good for Gold

The consumer price index (CPI), a measure of inflation, came in hotter than expected Friday, registering 2.3 percent year-over-year in August on expectations of 2.0 percent. With the five-year Treasury yielding 1.19 percent, government bond investors are now receiving a negative real rate of return (because 2.3 minus 1.19 comes out to negative 1.11 percent).

This is highly constructive for the price of gold. As I’ve discussed many times before, the yellow metal has benefited when real rates have fallen below zero. This was the case in September 2011 when gold hit its all-time high of $1,900 per ounce. And last year around this time, the opposite was true—positive real rates were a drag on gold.

Although gold sunk to a two-week low on a strong U.S. dollar and fears over this week’s Federal Reserve meeting, the drivers are firmly in place to push prices higher.

LEARN MORE ABOUT WHAT’S DRIVING GOLD

image: http://www.stockhouse.com/getattachment/e6e0c012-21a9-4caa-9e6b-e389ba158bf5/frank_919_2.png

Maybe you’ve heard that a new book out right now is planting propaganda in the war on cash. In “The Curse of Cash,” Harvard economics professor Kenneth Rogoff makes the case that nixing paper money—at the very least, larger-denominated bills—“could help more than you might think” in combating criminal activities such as drug trafficking, corruption, extortion and money laundering. It could even prevent the spread of terrorism and discourage illegal immigration, Rogoff argues.

It gets even worse. Central banks, he adds, should have the latitude to drop interest rates below zero during recessions to spur spending. If the Federal Reserve tried this now, of course, many people would likely convert their savings into paper—which at least yields 0 percent—and hoard it in bedroom safes. This is precisely what many Germans have reportedly done, prompting safe manufacturers to scramble to meet demand.

But in a world where nothing larger than a $10 bill exists, hoarding cash would be highly impractical. Better to buy that new boat you don’t need!

While we all agree that corruption and terrorism are things that should be stopped, killing cash is the absolute wrong way to go about it.

Instead, perhaps Rogoff should consider “The Curse of No Cash.” Does he not recall what happened in Cyprus just three years ago? The government ransacked citizens’ bank accounts to “fix” its own mistakes and mismanagement. In example after example, people’s rights to save and freely hold cash have been disrupted, with tragic results.

I’ve written about this topic before. In a cashless society, your economic liberty is forever at risk. Every transaction could be monitored, taxed and charged a fee. Capital controls would be crippling, assets could be seized. Just ask the Colombians and Venezuelans.

I’m not the only one who disagrees with the ideas in Rogoff’s polemic against money. As of this writing, nearly three quarters of Amazon customers have given the book a rating of two or fewer stars. And in a scathing Wall Street Journal op-ed, respected financial writer James Grant strips away the book’s “technical pretense” to uncover its true motive. Rogoff, he writes, “wants the government to control your money,” which is the extreme form of Keynesian economics.

Gold Has Shined Brightly During Currency Crises

There’s one area where Rogoff and I both agree, though. “As paper currency is phased out,” he writes, “gold prices will rise.” Were cash eliminated and interest rates plunged underwater, gold’s role as a store of value would become even more apparent and demand for the yellow metal would turn red hot, despite its price appreciation.

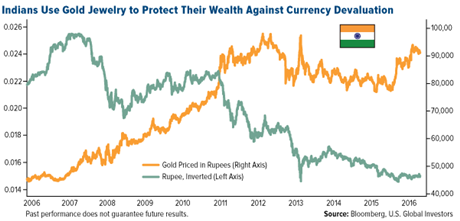

This has been the case in countless past examples. Rogoff himself cites Indians’ longstanding love of and cultural affinity to gold jewelry as protection against currency uncertainty. For centuries, inhabitants of the Indian subcontinent saw continuous regime change, not to mention imperialist rule by various European forces. During all this time, the one stable and widely accepted currency was gold.

image: http://www.stockhouse.com/getattachment/83c36518-3127-495e-ba64-6fedceb70f48/frank_919_3-(1).png

.png)

The tradition carries on today. A third of Indian gold jewelry demand comes from rural farmers, who annually convert a portion of their crop revenues into the yellow metal. Whether this gold is stored or given to a female family member, perhaps a daughter, before her wedding day, its purpose is twofold: one, as a beautiful heirloom to be worn and passed down to the next generation, and two, as a form of financial security.

It’s estimated that Indian households currently hold more than 20,000 tonnes of gold. To put that in perspective, 20,000 tonnes is more than the official gold holdings of the U.S., Germany, Italy, France, China and Russia combined.

With speculation strong that a rupee devaluation is imminent, it makes just as much sense now as ever for Indians to have at least some of their wealth in gold. When the rupee unexpectedly dipped to record lows in August 2013, the wealth that prudent Indians had stored in the precious metal was, for the time being, safe.

image: http://www.stockhouse.com/getattachment/f2a16064-fb6c-4ca9-8dc6-778821d7f7e0/frank_919_4.png

Although there’s little fear right now that the U.S. dollar is in trouble, I still recommend that investors maintain a 10 percent weighting in gold—5 percent in gold stocks, 5 percent in gold coins and jewelry.

Is Chicago Next to Declare Bankruptcy?

It’s not just Indian investors who should be aware of currency fluctuations and imbalances in monetary and fiscal policy. These can happen right here in our own backyards, and investors who aren’t paying attention—specifically municipal bond investors—could pay a steep price.

In the past few years, we’ve seen how financial mismanagement can bring calamity to state and local economies, the most notable example being Detroit’s $18 billion bankruptcy in July 2013, the largest in U.S. history. Right now, the U.S. territory of Puerto Rico is in dire financial straits, owing some $70 billion, more than any state government except California and New York.

And then there’s Chicago, which is looking at $170 billion in unfunded pensions and other costs.

This came to my attention earlier this month when I visited Chicago to attend the Morningstar ETF Conference. While there, I had the opportunity to speak to several locals, who shared with me their frustration of high local tax rates—some of the highest in the country.

Taxes are high, they said, mainly because of outrageous pensions for public and union workers. Entitlement spending has exploded. Now, Chicago, which has the lowest credit rating of any major U.S. city, is edging scarily close to bankruptcy.

Unfortunately, it isn’t hard to see why. For starters, the state has one of the most highly unionized workforces in the country, compared to the national average.

image: http://www.stockhouse.com/getattachment/787a431e-5c0a-41e8-9492-97ff183d748c/frank_919_5.png

And instead of reining in costs, state and city officials continue to add to the pile of debt. The Land of Lincoln already has the least funded retirement system in the country, according to Bloomberg, and is on track to end the year $7.8 billion in the hole.

Lawmakers and other government workers are among the highest paid in the nation and enjoy “Cadillac” health care benefits and pensions. It’s not uncommon for them to retire in their 50s. The Illinois Policy Institute estimates that the total annual operating cost for each state lawmaker—including salary, insurance and the like—stands at more than $100,000, with private taxpayers footing most of the bill.

“It’s like we work for the government,” one Chicagoan told me. “Everything we make goes to their pensions.”

Conveniently, the state constitution includes a clause that forbids any reduction of public pensions.

For these reasons, Illinois is saddled with some of the highest income and corporate taxes in the United States. Chicago’s sales tax is the highest of any major U.S. city. Despite the revenue this generates, it doesn’t come close to touching what’s been promised.

Look at the chart below. Between 2000 and 2015, Illinois tax revenue increased 57 percent. That’s a significant jump. But over the same period, state-employee insurance and pension benefits skyrocketed—166 and 586 percent respectively—while essential services such as higher education suffered.

image: http://www.stockhouse.com/getattachment/a9380262-5c6f-40ab-8b22-6e7620bbb809/frank_919_6.png

What this means is very little of taxpayers’ money is going toward anything tangible—new schools, new hospitals, new wastewater treatment plants. Nothing that provides jobs or has a multiple effect is being produced.

We’re already seeing serious consequences as a result of the state and city’s fiscal woes. In a recent study of jobs market competitiveness, CareerBuilder found that Chicago is the least competitive metropolitan area in the U.S. in terms of jobs growth. Between 2014 and 2015, the Windy City’s rate of adding jobs was far short of the national average.

Because of this—among other reasons, including crime, unemployment and political infighting—Chicago had the largest population loss of any metro in the U.S last year (6,263). Meanwhile, Illinois was one of only seven states to see a net decline (22,194).

And where are these people going? Where the jobs are, of course. I always say that money flows where it’s most respected. People behave the same way.

It’s no wonder, then, that the state that attracts the most Illinois expats is Texas, according to the Chicago Tribune. This falls in line with what I wrote just a couple of weeks ago. Between 2014 and 2015, Texas added more residents than any other state because of its strong economy, abundance of jobs and low taxes. CareerBuilder’s jobs study, I should point out, rated Dallas as the most competitive city. And within the next eight to 10 years, Houston is expected to surpass Chicago to become the nation’s third largest city by population.

I’m not saying this to beat up on Chicago, but to emphasize my earlier point about being aware and prepared—especially, in this case, when it comes to municipal bond investing. Many passive muni funds might hold Chicago debt because it’s high-yielding. But those yields could come at a huge cost. Three years ago, bondholders of Detroit’s bad debt learned the hard way that, in the event of a default, pensioners get paid first, investors last—or worse, not at all.

As active managers we’re well aware of this. We sincerely hope Chicago can straighten out its balance sheet, but in the meantime, we feel it’s not a space to be a buyer right now. Instead, we seek to invest primarily in high-quality, short-term munis, and that means staying away from irresponsible government policy.

LEARN MORE ABOUT SHORT-TERM MUNIS

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article was held by any accounts managed by U.S. Global Investors as of 6/30/2016.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Read more at http://www.stockhouse.com/opinion/independent-reports/2016/09/19/the-war-on-cash-still-good-for-gold#B2tsLUDJLQZ13xKu.99

By Frank Holmes

Full Article : The War on Cash is Still Good for Gold

Disclaimer© 2010 Junior Gold ReportJunior Gold Report’ Newsletter: Junior Gold Report’s Newsletter is published as a copyright publication of Junior Gold Report (JGR). No Guarantee as to Content: Although JGR attempts to research thoroughly and present information based on sources we believe to be reliable, there are no guarantees as to the accuracy or completeness of the information contained herein. Any statements expressed are subject to change without notice. JGR, its associates, authors, and affiliates are not responsible for errors or omissions. Consideration for Services: JGR, it’s editor, affiliates, associates, partners, family members, or contractors may have an interest or position in featured, written-up companies, as well as sponsored companies which compensate JGR. JGR has been paid by the company written up. Thus, multiple conflicts of interests exist. Therefore, information provided herewithin should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. No Offer to Sell Securities: JGR is not a registered investment advisor. JGR is intended for informational, educational and research purposes only. It is not to be considered as investment advice. Subscribers are encouraged to conduct their own research and due diligence, and consult with their own independent financial and tax advisors with respect to any investment opportunity. No statement or expression of any opinions contained in this report constitutes an offer to buy or sell the shares of the companies mentioned herein. Links: JGR may contain links to related websites for stock quotes, charts, etc. JGR is not responsible for the content of or the privacy practices of these sites. Release of Liability: By reading JGR, you agree to hold Junior Gold Report its associates, sponsors, affiliates, and partners harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries (financial or otherwise) that may be incurred.

Forward Looking Statements

Except for statements of historical fact, certain information contained herein constitutes forward-looking statements. Forward looking statements are usually identified by our use of certain terminology, including “will”, “believes”, “may”, “expects”, “should”, “seeks”, “anticipates”, “has potential to”, or “intends’ or by discussions of strategy, forward looking numbers or intentions. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results or achievements to be materially different from any future results or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts, and include but are not limited to, estimates and their underlying assumptions; statements regarding plans, objectives and expectations with respect to the effectiveness of the Company’s business model; future operations, products and services; the impact of regulatory initiatives on the Company’s operations; the size of and opportunities related to the market for the Company’s products; general industry and macroeconomic growth rates; expectations related to possible joint and/or strategic ventures and statements regarding future performance. Junior Gold Report does not take responsibility for accuracy of forward looking statements and advises the reader to perform own due diligence on forward looking numbers or statements.